Getting Rich Slowly: Understanding investment risk, retirement withdrawals, and tax-efficient growth.

- Kevin Ridgway, CFP

- Aug 8, 2024

- 2 min read

Investment Risk: Building wealth often involves taking calculated risks. Successful investors recognize that some level of risk is necessary to achieve substantial returns. Diversifying your portfolio and understanding risk tolerance are key considerations. The most popular way for investors to engage with the stock market is through Mutual funds or ETF's. This is the easiest, and most cost efficient way for an investor to gain access to the best companies around the world and build a globally diversified portfolio, that can be tailor made to your financial goals and time horizon.

Rising Living Costs: As you plan for retirement, consider the impact of inflation and rising living expenses. Successful investors prepare by adjusting their investment strategies to account for these factors.

Retirement Withdrawals: Savvy investors manage their retirement withdrawals strategically. Balancing income needs with portfolio growth is crucial. Understanding tax implications and withdrawal timing can optimize your financial situation. Please don't listen to anyone that tells you about a certain percentage you can take out of your portfolio each year - it's all subjective. The '4% rule' is a lousy rule of thumb, and by no means a credible retirement plan that you should listen to.

Estate Planning: High net worth individuals know when to create and update their estate plans. Proper estate planning ensures the smooth transfer of assets, minimizes taxes, and protects your legacy.

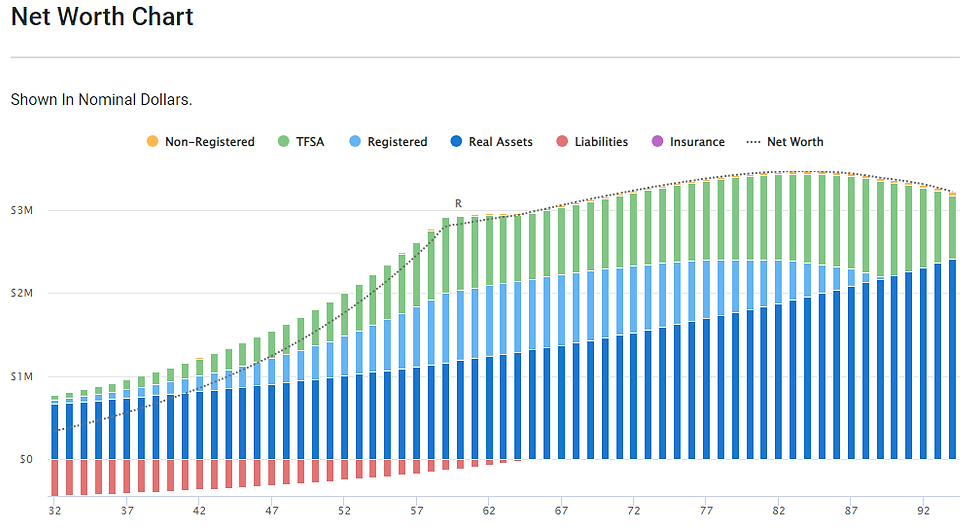

Tax Efficient Growth: Savvy investors all take advantage of the room available to them within their registered accounts. This can include, but is not limited to their RRSP's, TFSA's, RESP's, Pension's, and Locked-in RSP's. The ability for money inside of these accounts to snowball without being interrupted by taxes, allows the value of these accounts to grow more efficiently, and therefore quicker. This may also include investments within a corporation for Canadians who operate a small business or are incorporated due to their professional obligations.

Now, let's take a look at this in real time - so you can see some of the struggles from a behavioral standpoint. In theory, all the above sounds simple, but it's not easy.

Here is one of the worst market timers in history..

Here's Bob to share his story.. (excellent short video)

Moral of the story: The timing of your investment in the market is not as crucial as the duration for which you remain invested. Tune out the noise and stick to a plan. Get rich slowly.

Comments